Are we in a 'credit crunch' yet? Is one coming? | interest.co.nz

2022 has opened with more talk about an impending "credit crunch".

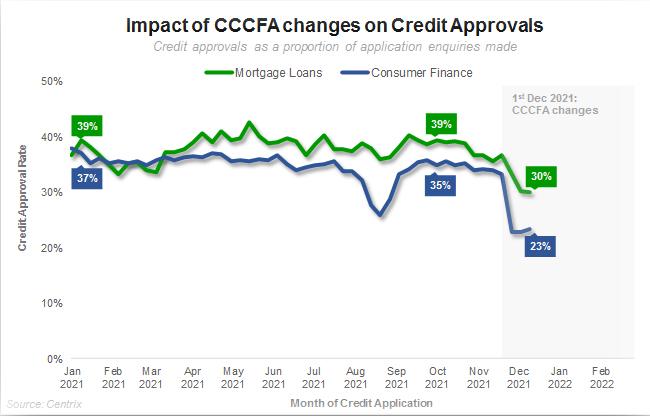

Credit bureaux Centrix and Equifax have both made holiday releases pointing out how much and how fast the pullback was in December in loan applications.

Equifax described it as a "plummet", Centrix is noting a "hard hit", specifically from the CCCFA changes.

Here are the Equifax observations. Centrix is seeing 1 in 5 mortgage loan approvals hit by the new CCCFA regulations (i.e. consumers that were previously approved are no longer under these CCCFA changes), and 1 in 3 consumer finance approvals have been impacted by CCCFA.

For mortgages, they see a lending commitment slowdown of -23% of almost -$2 bln (going from $8.3 bln per month to $6.4 bln per month.

The CCCFA is getting all the blame. The mortgage broking industry is worried about what it will do to their business model and is organising its clients to petition officials. The Commerce minister is rattled.

Of course, all this is superficial. The base from what all this is being measured against is probably unrealistic. The CCCFA is just one of a series of measures put in place to restrain rampant credit growth and an unsustainable housing market. The object is to arrest the trajectory, and in 2022 we may be seeing the fruits of these policies - finally after decades if ineffectual action.

But if a credit crunch is coming, as unusual as it might be in New Zealand, it is probably wise to understand what it really is.

With apologies to Wikipedia, here is how it is described there.

Acredit crunch (also known as acredit squeeze,credit tightening orcredit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises).

Causes

A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investors in debt when the loans turn sour and the full extent of bad debts becomes known.

There are a number of reasons why banks might suddenly stop or slow lending activity. For example, inadequate information about the financial condition of borrowers can lead to a boom in lending when financial institutions overestimate creditworthiness, while the sudden revelation of information suggesting that borrowers are or were less creditworthy can lead to a sudden contraction of credit. Other causes can include an anticipated decline in the value of the collateral used by the banks to secure the loans; an exogenous change in monetary conditions (for example, where the central bank suddenly and unexpectedly raises reserve requirements or imposes new regulatory constraints on lending); the central government imposing direct credit controls on the banking system; or even an increased perception of risk regarding the solvency of other banks within the banking system.

Easy credit conditions

Easy credit conditions (sometimes referred to as "easy money" or "loose credit") are characterized by low interest rates for borrowers and relaxed lending practices by bankers, making it easy to get inexpensive loans. A credit crunch is the opposite, in which interest rates rise and lending practices tighten. Easy credit conditions mean that funds are readily available to borrowers, which results in asset prices rising if the loaned funds are used to buy assets in a particular market, such as real estate or stocks.

Bubble formation

U.S. house price trend (1987–2008) as measured by the Case-Shiller index. Between 2000 and 2006 housing prices nearly doubled, rising from 100 to nearly 200 on the index.

In a credit bubble, lending standards become less stringent. Easy credit drives up prices within a class of assets, usually real estate or equities. These increased asset values then become the collateral for further borrowing. During the upward phase in the credit cycle, asset prices may experience bouts of frenzied competitive, leveraged bidding, inducing inflation in a particular asset market. This can then cause a speculative price "bubble" to develop. As this upswing in new debt creation also increases the money supply and stimulates economic activity, this also tends to temporarily raise economic growth and employment.

Economist Hyman Minsky described the types of borrowing and lending that contribute to a bubble. The "hedge borrower" can make debt payments (covering interest and principal) from current cash flows from investments. This borrower is not taking significant risk. However, the next type, the "speculative borrower", the cash flow from investments can service the debt, i.e., cover the interest due, but the borrower must regularly roll over, or re-borrow, the principal. The "Ponzi borrower" (named for Charles Ponzi, see also Ponzi scheme) borrows based on the belief that the appreciation of the value of the asset will be sufficient to refinance the debt but could not make sufficient payments on interest or principal with the cash flow from investments; only the appreciating asset value can keep the Ponzi borrower afloat.

Often it is only in retrospect that participants in an economic bubble realize that the point of collapse was obvious. In this respect, economic bubbles can have dynamic characteristics not unlike Ponzi schemes or Pyramid schemes.

Psychological

Several psychological factors contribute to bubbles and related busts.

These and other cognitive biases that impair judgment can contribute to credit bubbles and crunches.

Valuation of securities

The crunch is generally caused by a reduction in the market prices of previously "overinflated" assets and refers to the financial crisis that results from the price collapse. This can result in widespread foreclosure or bankruptcy for those who came in late to the market, as the prices of previously inflated assets generally drop precipitously. In contrast, a liquidity crisis is triggered when an otherwise sound business finds itself temporarily incapable of accessing the bridge finance it needs to expand its business or smooth its cash flow payments. In this case, accessing additional credit lines and "trading through" the crisis can allow the business to navigate its way through the problem and ensure its continued solvency and viability. It is often difficult to know, in the midst of a crisis, whether distressed businesses are experiencing a crisis of solvency or a temporary liquidity crisis.

In the case of a credit crunch, it may be preferable to "mark to market" - and if necessary, sell or go into liquidation if the capital of the business affected is insufficient to survive the post-boom phase of the credit cycle. In the case of a liquidity crisis on the other hand, it may be preferable to attempt to access additional lines of credit, as opportunities for growth may exist once the liquidity crisis is overcome.

Effects

Securitization markets were impaired during the crisis. This shows how readily available credit dried-up during the 2007-2008 crisis.

Financial institutions facing losses may then reduce the availability of credit, and increase the cost of accessing credit by raising interest rates. In some cases lenders may be unable to lend further, even if they wish, as a result of earlier losses. If participants themselves are highly leveraged (i.e., carrying a high debt burden) the damage done when the bubble bursts is more severe, causing recession or depression. Financial institutions may fail, economic growth may slow, unemployment may rise, and social unrest may increase. For example, the ratio of household debt to after-tax income rose from 60% in 1984 to 130% by 2007, contributing to (and worsening) the Subprime mortgage crisis of 2007–2008.

Historical perspective

In recent decades credit crunches have not been rare or black swan events. Although few economists have successfully predicted credit crunch events before they have occurred, Professor Richard Rumelt has written the following in relation to their surprising frequency and regularity in advanced economies around the world: "In fact, during the past fifty years there have been 28 severe house-price boom-bust cycles and 28 credit crunches in 21 advanced Organisation for Economic Co-operation and Development (OECD) economies."

Like much of Wikipedia, this content is very US-focused. But it is instructive all the same.

What is clear is that currently we aren't at a full "credit crunch" situation yet. The fact that mortgage brokers are not able to do as much business as they used to is not part of the definition of a credit crunch - and it isn't necessarily a bad thing.

Decades of not dealing properly with "the housing crisis" has always meant that when effective action is eventually taken, some people will be hurt more than if proper action has been take much earlier in the cycle. That however should not stop eventually taking proper action.

There has grown a political penchant to only take corrective public policy action so long as no-one actually gets hurt. Obviously that is a very poor way to fix a very large public policy problem. The sooner a big correction is behind us, the better - if affordable housing is the objective. Houses should always only have been 'shelter' - when they became an "investment" and a tax-dodge after the Clark/Cullen income 39% tax rate, Kiwi DNA changed. It needs to change back.